Modern Lending Technology Built for Banks

Maxwell helps banks bring modern lending technology into their mortgage operations, combining speed and automation with the personal, relationship-driven service that defines your institution.

Our platform streamlines workflows, reduces time to close, and improves borrower satisfaction, all while integrating seamlessly with your existing LOS, pricing engine, and compliance tools.

Create a borrower experience that’s distinctly yours

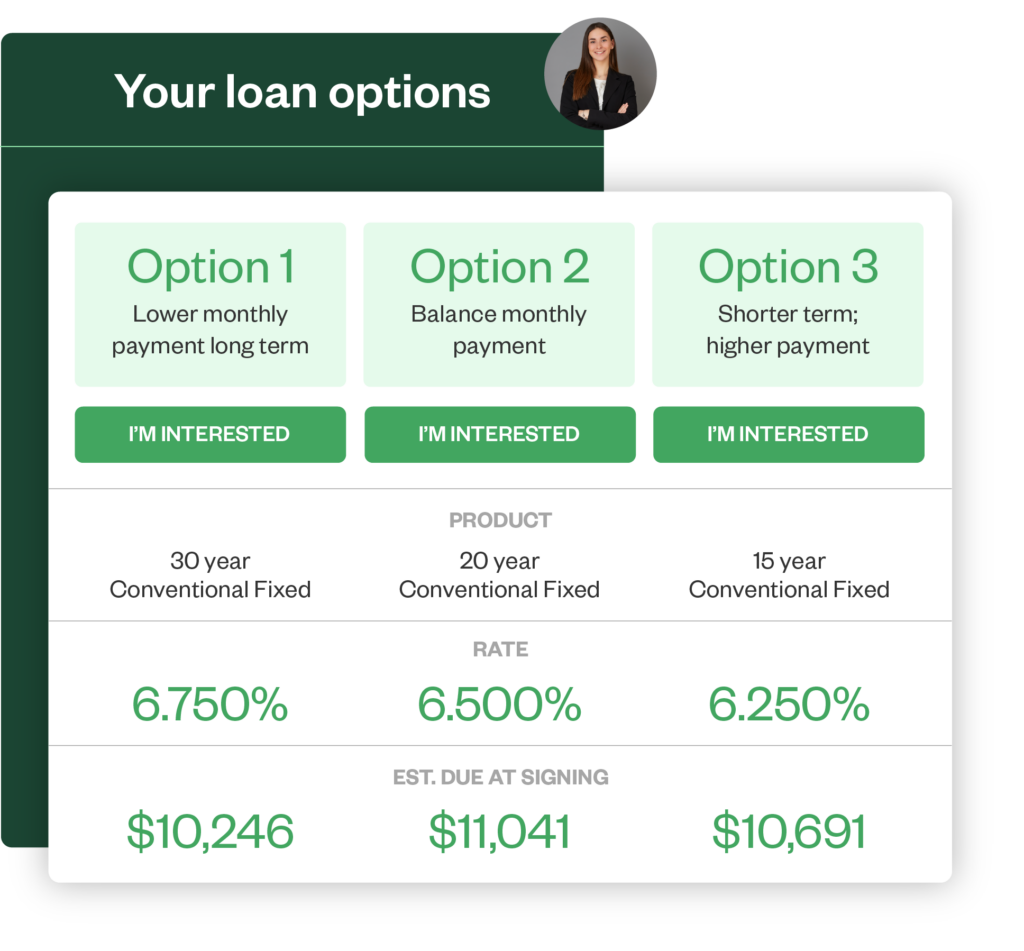

With Maxwell Point of Sale, banks can create a fully branded borrower experience that mirrors your institution’s identity. Maxwell’s industry-first configurability allows you to tailor workflows, business rules, and borrower journeys with no-code required.

Reduce manual work so your lending team can focus on borrowers

Margins are tight, and manual processes waste valuable time. Maxwell automates routine tasks like document validation, data entry, and reporting, freeing loan officers, processors and underwriters to focus on service, strategy, and sales.

Make data-backed decisions with confidence

Maxwell Business Intelligence gives banks real-time visibility into their mortgage pipeline. No more manual reports or delayed insights. With AI-powered dashboards, you can identify bottlenecks, measure performance, and forecast more accurately.

Banks using Maxwell see

13+

Days saved per closed loan

44%

Higher pull-through

60+

integrations to create the workflows you need

Hear from Maxwell customer Country Bank

Discover how Country Bank transformed its mortgage operation using Maxwell Point of Sale. achieving an 87% application submission rate and boosting submissions by over 5% year-over-year. By automating workflows, integrating seamlessly with their LOS, and delivering a branded digital experience, Country Bank empowered loan officers to focus on relationships, not paperwork. The result? Faster closings, happier borrowers, and high-performing LOs driving business growth.