Committed to credit union success

Credit unions play a vital role in expanding access to homeownership and Maxwell shares your mission. We believe a mortgage isn’t just a transaction, it’s a milestone that shapes lives and communities.

That’s why we’ve built technology specifically to help credit unions increase efficiency, grow loan volume, and elevate the borrower experience.

Maxwell partners: A commitment to credit unions

A smarter, faster mortgage experience for your members

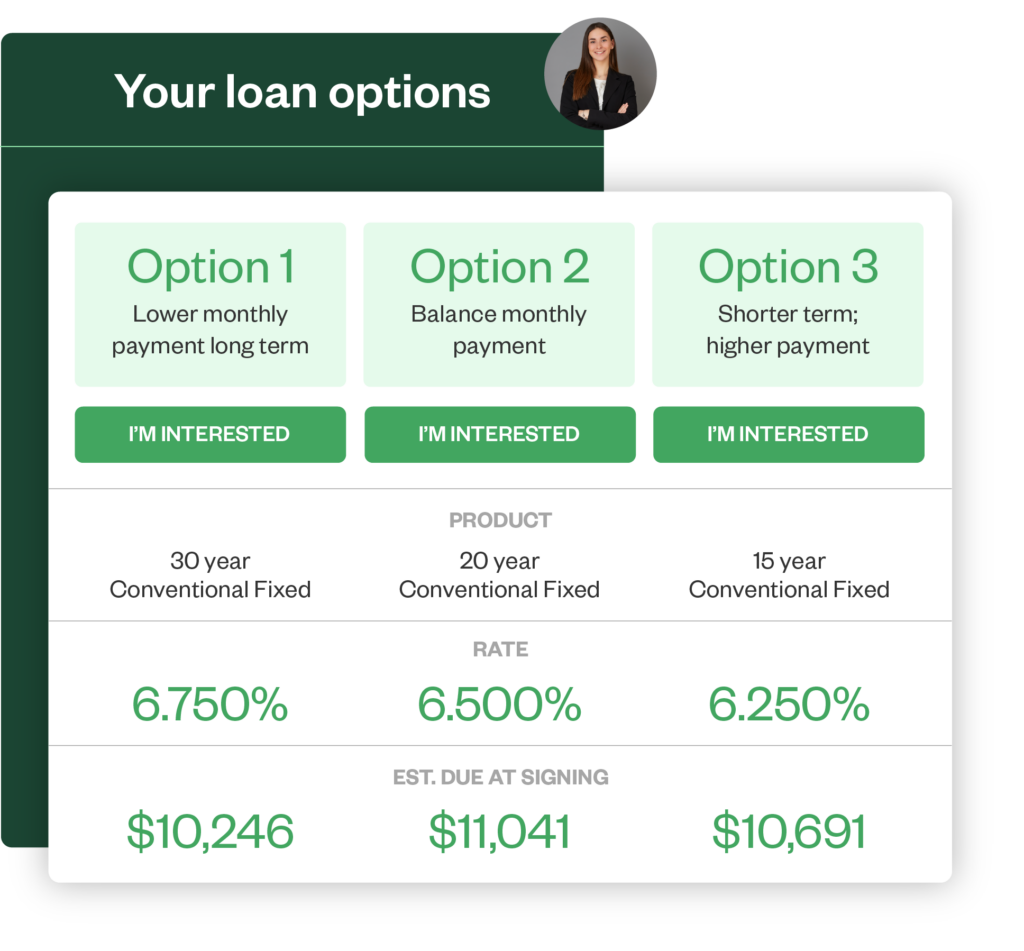

Maxwell Point of Sale to delivers a seamless, branded mortgage experience that reflects their community-first values. By automating document collection, validating files instantly, and guiding members through every step, Maxwell POS helps teams close loans faster and focus on building relationships. The result is a modern, intuitive process that improves application completion and enhances member satisfaction.

Tailor mortgage workflows to fit your unique needs

Maxwell POS offers fully customizable workflows that adapt to your credit union’s unique processes and operational needs. From configuring product-specific business rules to automating internal tasks and routing files based on team roles, Maxwell ensures your lending operations run efficiently and consistently.

Unlock real-time insights into your mortgage operations

Maxwell Business Intelligence gives credit unions real-time visibility into their mortgage pipeline. Say goodbye to manual reports and delayed insights as AI-powered dashboards let your team identify bottlenecks, monitor performance, and forecast loan volume with accuracy, so you can optimize operations and support your members more effectively.

Hear from Maxwell customer Ent Credit Union

Ent Credit Union uses Maxwell Business Intelligence to transform its lending operations with real-time, actionable data, eliminating tedious spreadsheets and manual reporting. With customizable dashboards and AI-powered “AskMax” insights, their team can monitor pipeline health, track process bottlenecks, and make strategic decisions that improve efficiency and member service. By partnering with Maxwell, Ent has freed up capacity, gained deeper visibility, and built a transparent, high-impact reporting process.