Maxwell Point of Sale

Technology for a modern mortgage experience

Stand out from the competition with a digital mortgage process that delights borrowers, helps loan officers outproduce their peers, and reduces the time to close by 13+ days.

Make AI work for you and your borrowers

Focus on high-impact, judgment-based work while AI handles repetitive tasks.

Customize with robust integrations and configurability

Access hundreds of connected partners and extensive customizations.

Leverage innovative technology to empower and retain top talent.

Turn more leads into loans with an intuitive, streamlined experience.

Implement quickly and access enterprise-grade security and support.

Maxwell POS impact, compared to other mortgage POS solutions

9%

More loans closed per LO

44%

Higher pull-through

20%

Faster from lock to clear-to-close

AI that adapts to you, not the other way around

Maxwell is the first mortgage point-of-sale with AI that adapts to your unique workflows.

Impress borrowers with a white-labeled AI experience

Gain trust and show borrowers you are ahead of the game.

Save time so you can focus on high-impact work

Let AI take care of the simple tasks for you, like document legibility checks.

Send cleaner loan files to underwriting

Save back and forth with your operations team.

Move loans through your pipeline faster

Smart AI works alongside you, saving critical days and increasing your team capacity.

Industry-first configurability and customization

Fully customize your point of sale to fit your organization’s unique needs.

Customized workflows

We help you to build fully customized workflows to boost your efficiency.

A differentiated experience

Adapt your borrower experience to stand out from the competition.

Save costs with bundled integrations

Integrate with as many of our over 60 third-party integrations as your organization requires.

See a list of our integrations here.

No developers needed

Add to your tech stack without the costly expense of hiring developers.

Define business rules by product

Specify rules for any mortgage product, including construction loans, manufactured home loans, home equity loans, bridge loans, and more.

Read more about Maxwell’s industry-first configurability in HousingWire.

Enable loan officer success

Leverage innovative technology to empower and retain top talent.

Smart workflow automation

Remove grunt work by automating basic tasks like tracking loan file progress, collecting documents, running credit checks, sharing pricing scenarios, verifying income or employment with Day 1 Certainty®, and more.

Real estate agent collaboration

FlexLetters™ supports real estate agent partners by giving them the ability to edit pre-approval and pre-qualification letters on the fly.

Access hundreds of connected partners and integrations

Use your existing tech stack to connect to Maxwell Point of Sale.

LOS (Loan Origination System)

Maxwell connects to a wide range industry-leading LOS systems including Encompass, MeridianLink, Finastra, Mortgagebot, Byte and more.

Product Pricing Engines

Maxwell has partnered with top pricing engines to ensure that your borrowers have accurate information. Our integrations include Optimal Blue, Mortech, Polly, MeridianLink PriceMyLoan, Encompass Product & Pricing Engine, and ClosingCorp SmartFees.

Verification Suite

Our Verification Suite brings together Day 1 Certainty-approved suppliers to help originators and borrowers seamlessly complete verifications within Maxwell. Our partners include The Work Number, TrueWork, Finicity and AccountChek.

Gain a dedicated partner

Implement quickly and access enterprise-grade security and support.

Rapid implementation & support

Our POS is fast to implement for enterprise clients, averaging less than 2.5 weeks from kick-off to launch. Maxwell is built in Colorado, and our US-based support team is ready to solve problems quickly with attention and empathy.

Enterprise-level security

Maxwell is proudly SOC 2 Type II certified, reinforced by regular 3rd party audits and testing. All data is encrypted in transit and at rest with AES-256, block-level storage encryption—the same technology that banks use to keep personal information safe. Maxwell Point of Sale also offers single-sign-on that integrates with most SSO systems.

Partnership first

We use everything from a shared product roadmap to regular check-ins to make sure Maxwell is advancing your goals. Our partnership-first approach ensures that you have a trusted advisor beyond the point of sale, and into other areas of our origination expertise.

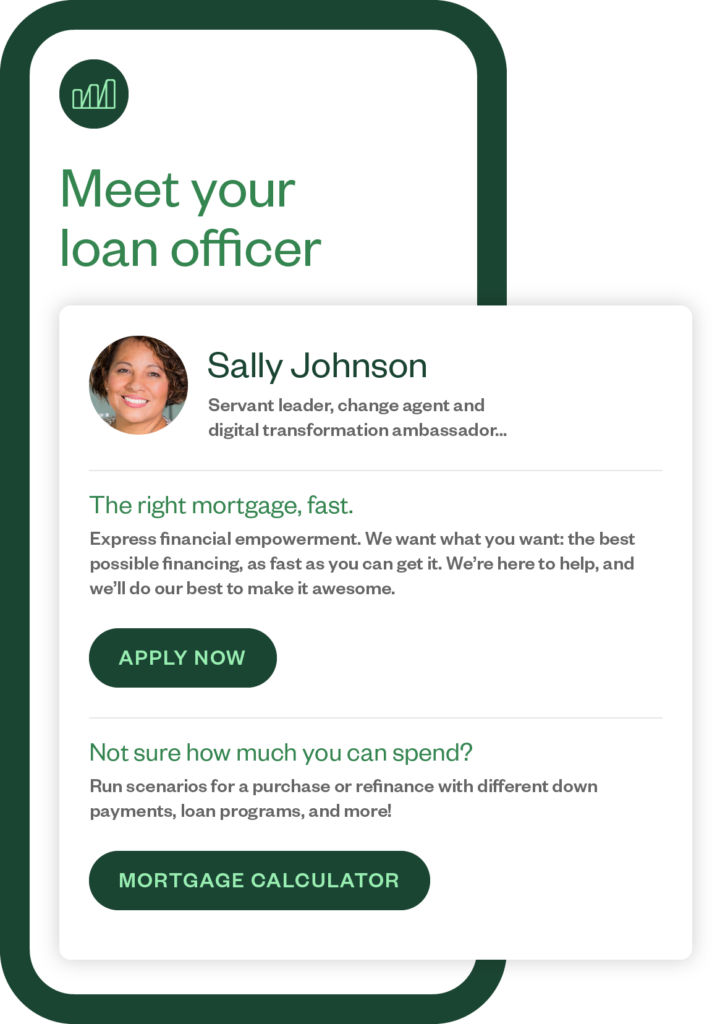

Exceed borrower expectations

Turn more leads into loans with an intuitive, streamlined experience.

End-to-end digital experience with eClosing

From application to closing, our consumer-grade mortgage experience delivers a fast, seamless mortgage experience that conforms to state and county regulations.

Se habla español

Borrowers can complete the entire loan application in Spanish and the resulting loan file still meets all language and information requirements in the LOS.

Maxwell eSign

Maxwell’s new eSign solution eliminates the need for manual signatures and the time-consuming process behind it. Your borrowers will love being able to sign documents within the Point of Sale, anytime, anywhere.

Denise Walker

SVP/Director of Retail Lending, Country Bank

“Maxwell Point of Sale helps us provide borrowers with a modern, digital experience so that we can handle more applications and close loans more efficiently.”

—Denise Walker, SVP/Director of Retail Lending, Country Bank