Mortgage Executives

Future-proof your lending business

Technology’s impact on the mortgage industry extends beyond loan applications and document management. Maxwell’s team of technology experts and mortgage veterans partners with forward-looking lenders like you to solve market challenges and help you thrive.

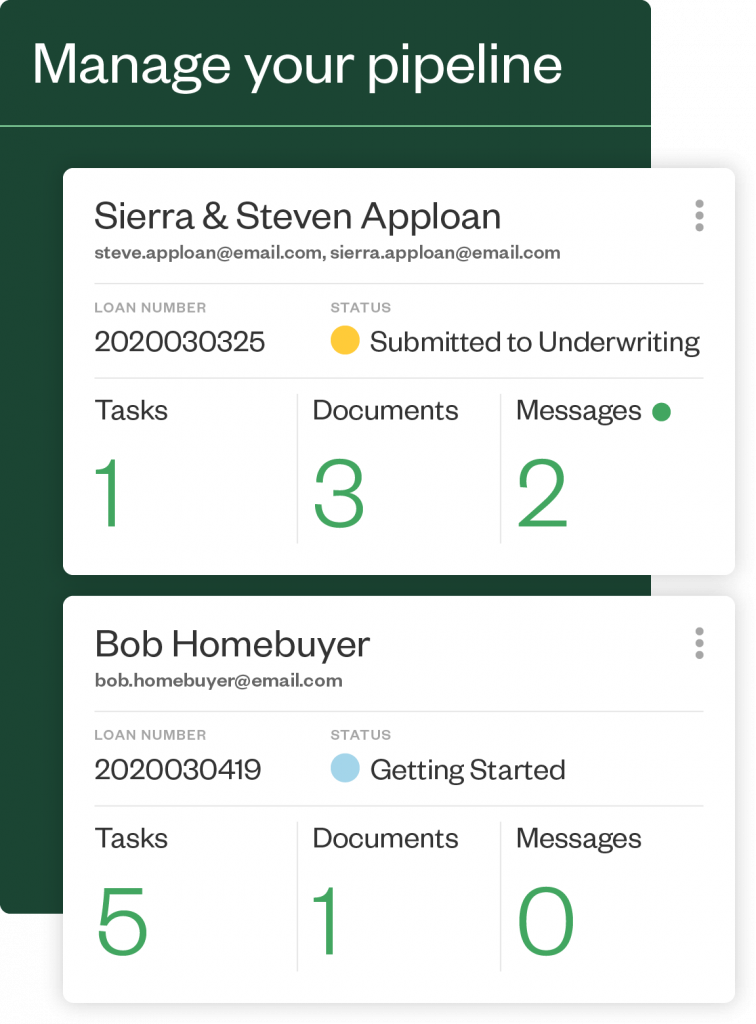

Gain a competitive advantage with technology the way you want

No one knows your business like you do. That’s why Maxwell Point of Sale is fully customized to fit the unique needs of your organization.

Gain complete control over the borrower experience and internal workflows without relying on custom development.

A partnership with an immediate impact

From initial implementation to world-class support and a dedicated Customer Success Manager, the Maxwell team is a partner every step of the way. Your success is our success.

91% borrower satisfaction score

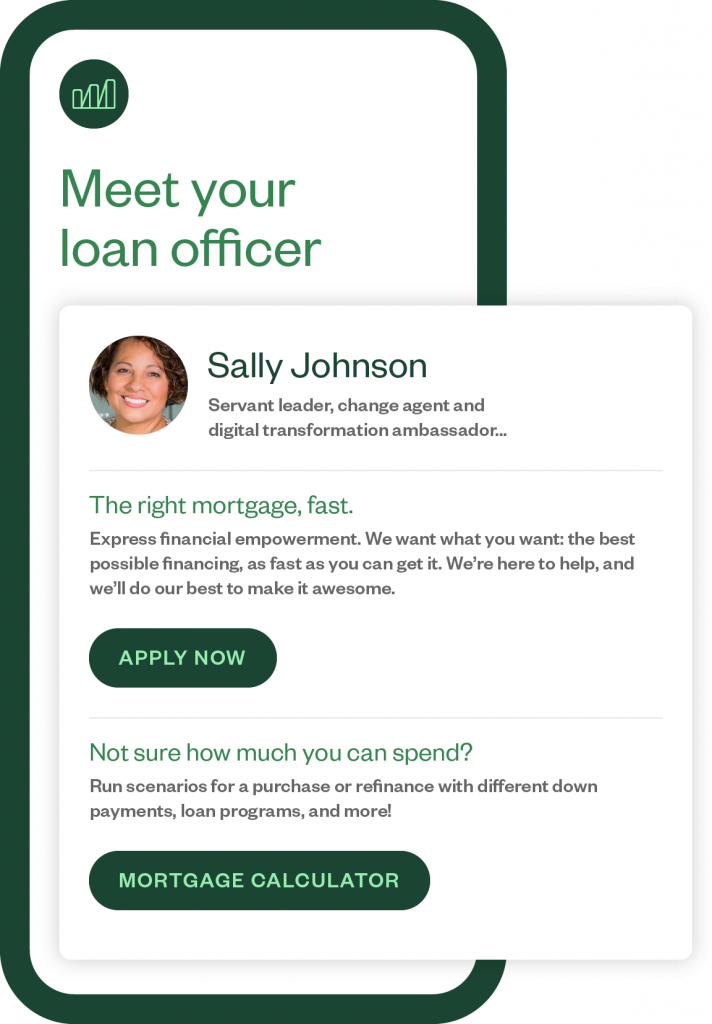

Attract and retain talented LOs

When you use any or all of Maxwell’s solutions, you give your loan officers the power to close more loans, increase referrals, and earn more money, making your business the place where top producers want to work.

15% more loans closed per month by LOs on Maxwell

Mortgage-specific analytics at your fingertips.

Unlike generic analytics platforms, Maxwell Business Intelligence is purpose-built for mortgage lending, with pre-configured dashboards and AI-powered querying that give leaders real-time answers to their most pressing questions. Paired with deep industry context and seamless integration into Maxwell’s mortgage suite, it turns data into actionable intelligence from day one, empowering lenders to make faster, more strategic decisions without waiting on IT or central BI teams.

Reports specific to executives, including market volume and borrower demographics.

Featured Customer

Read how Homeowners Financial Group saw a 38% increase in loan file speed from application to processing after partnering with Maxwell.